Baseplate provides a range of highly tailored software solutions for financial service providers

Our products are focused on optimising business for insurance, investment and mortgage operations, from advisers to FAP's. The products improve client engagement, productivity, compliance and business focus.

1.0

Applications,

Modules and

Services

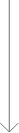

The Baseplate Applications are built on dynamic and customisable modules and services and the Baseplate Cloud Platform.

Current financial services - applications, modules & services - are shown in the following diagram:

2.0

User

Applications

Leveraging the dynamic Baseplate platform, Baseplate creates an 'end-to-end' solution with Applications covering client engagement and onboarding tools, a highly tailored Adviser Work Bench combining CRM, advice process and compliance management, data importing, through to fees & commission processing. You'll have everything you need in a single, easy-to-use offering.

Work Bench

Click here for full details.

Forms

Click here for full details.

Comm

Click here for full details.

Web Portal

Click here for full details.

Portal

Click here for full details.

Advisor Work Bench

Comes in the original Desktop and recent Browser versions.

- The Desktop is the original feature rich application.

- The Browser is currently a 'lite' version focussing on Account, Contact, workflow management and Client Portal administration, primarily designed for easy access and visibility for mobile advisers.

Email

Browser - Office 365 integration with Outlook with plug-in for filing and attachments.

Desktop - Internal email engine. POP based.

Receive, generate and file emails against Contacts and/or Accounts Activity.

Calendar and Appointments

Office 365 integration.

Record appointments and share with other system users.

Contacts

Office 365 integration.

Set up 'people' as Contacts and link to Accounts with defined roles.

Tasks

Set up tasks and record against Contacts and/or Accounts, with reminders.

Accounts

Set up 'discrete businesses' as Accounts, linked with Contacts. Lodge financial products under Accounts. Create 'Master Accounts' with linked 'Subaccounts'

to group related business.

Activity

Record emails, tasks, notes, general notes and document engine generated documents. Store external documents under a note. Sort and filter activity.

Workflow management

The ability to create workflows to manage key business processes and compliance.

Template Document and/or email generation

A document engine with Microsoft Word and an internal word equivalent with auto-populating merge symbols. An email template engine with auto-populating merge symbols.

Application processing

The ability to manage the onboarding through to application processing for mortgage, insurance and investment.

Alerts

The ability to notify advisers, support staff and management of tasks, actions or processes that are outside of agreed tolerances for follow up.

Compliance

Track key compliance processes and alert those outside of agreed process. The ability for advisers and management to view and manage.

Filtering

A filtering engine allowing filtering across standard fields and custom UDF's

Querying and reporting

Using SQL, the ability to query and report across the data fields and export.

Financial Product Recording and reporting

Mortgage, insurance and investment product recording, with standard and custom built reporting

Insurance

Data entry for providers, policy, benefits, exclusions and premium against owners and beneficiaries.

Investment

Transactional or positional investment history.

Data entry for investment, product, prices and FX rates.

Reporting of value, gain, performance, taxation, FUM and KPIs.

Compliance including AML and FATCA.

Asset allocation models, templates, portfolios, tolerances and implementation.

Bulk entry for distributions.

Data feeds.

Event driven implementation with authorised team release.

PV and returns graphs on dashboards with Snapshots.

Alerts.

Fees generation and processing.

Mortgage

Loan discovery, analysis and application preparation.

Loan management.

Refix management.

Financial Position Recording

The ability to record income, expenses, assets and liabilities.

Used in mortgage application processing.

Audit Trail

An audit of user activity and actions to trace all use and assist in correcting mistaken system use.

Permission Control

The ability to limit the use and visibility of data and system functionality by user and/or user type.

Xero

API integration.

Web Forms

Fully integrated web enabled forms to support the client discovery, risk profiling, review business and application processes.

Client data entry

Fully customisable web enabled forms for client data entry and direct feed into the Baseplate Platform for processing and

client plus 3rd party databases as required.

Other options

Client review and details update.

Client risk profiling.

Lead generation setting up Contacts and Account details for follow up conversion.

FeeComm

A ledger based fees and commission processing and management software system for larger scale insurance,

investment and mortgage operater.

Delivered as a stand-alone system or CRM integrated using API capability.

A cloud based browser system.

Stand-alone or integrated

The system can operate stand-alone. Or integrated with AWB for additional business

intelligence including sales pipeline and cash flow. Products in AWB are linked to the Fees & Commission ASP to bring products and adviser data

into an integrated business system.

Lender spreadsheet import

Spreadsheet data for loans, insurance policies, payments (upfront and trail) and clawbacks are imported.

Reconciliation

Product supplier payments are reconciled against a product and adviser. Payments to advisers, management advisers, referrers, Withholding Tax and

the Licence are included.

Batch creation and finalisation

A new batch is created.

The system provides a list of all unprocessed commission lines and a proposed allocation to advisers, management advisers, referrers, Withholding Tax and the Licencee.

The ability to make adjustments in the adviser ledger.

File and reports

Download an AFI file for final bank transfers.

Download adviser's statements, management reports of summary payments for advisers and referrers, management accounting reports including Withholding Tax to be paid.

Integration

Integrations with other systems can be done. For example, API integration with Xero.

Client Web Portal

Fully customisable web portal for clients integrated into the Platform giving the adviser the ability to control the engagement process.

Client access to data

Ability to provide clients with reports and a view on their data stored within Baseplate.

Client data collection

Customised web forms for client discovery, profiling and review processes integrated into the companies CRM and database.

Adviser controlled

Client access and data provided is controlled by the adviser from within their Baseplate CRM system.

Import Portal

A browser-based system to import and manage financial service product updates from product providers.

3.0

Pricing and

investment

- Pricing is based on the individual requirements of each user.

- Requirement scoping, customisation, tailored development, data migrations, implementation, training and subscriptions are quoted and agreed using our standard proposal process.

- Master Licence Agreements are put in place for each product and/or service provided.

How can we help?

We can help you create tailored solutions to increase efficiencies, save time and lift your bottom line. Let's talk.